Provided it covers the basic information listed above, you can generate many different types of receipts.

#Sales receipts code#

There might also be some promotional information like a discount code to use on future sales, a QR code, or the sales associate’s name.

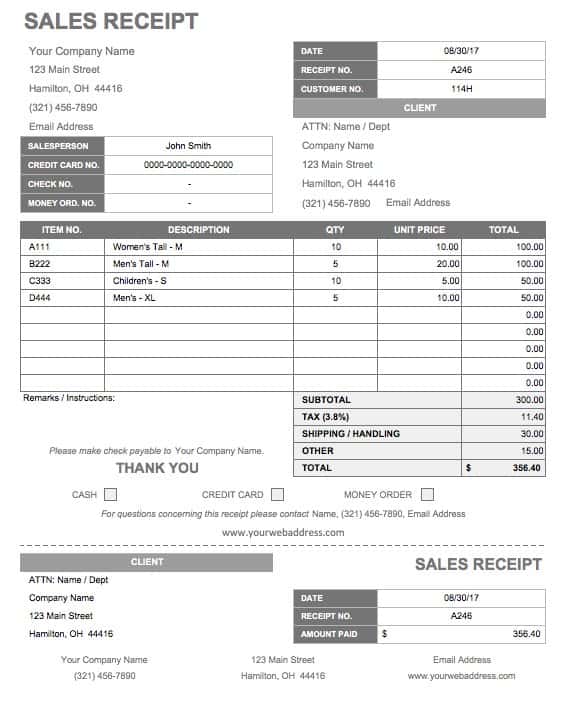

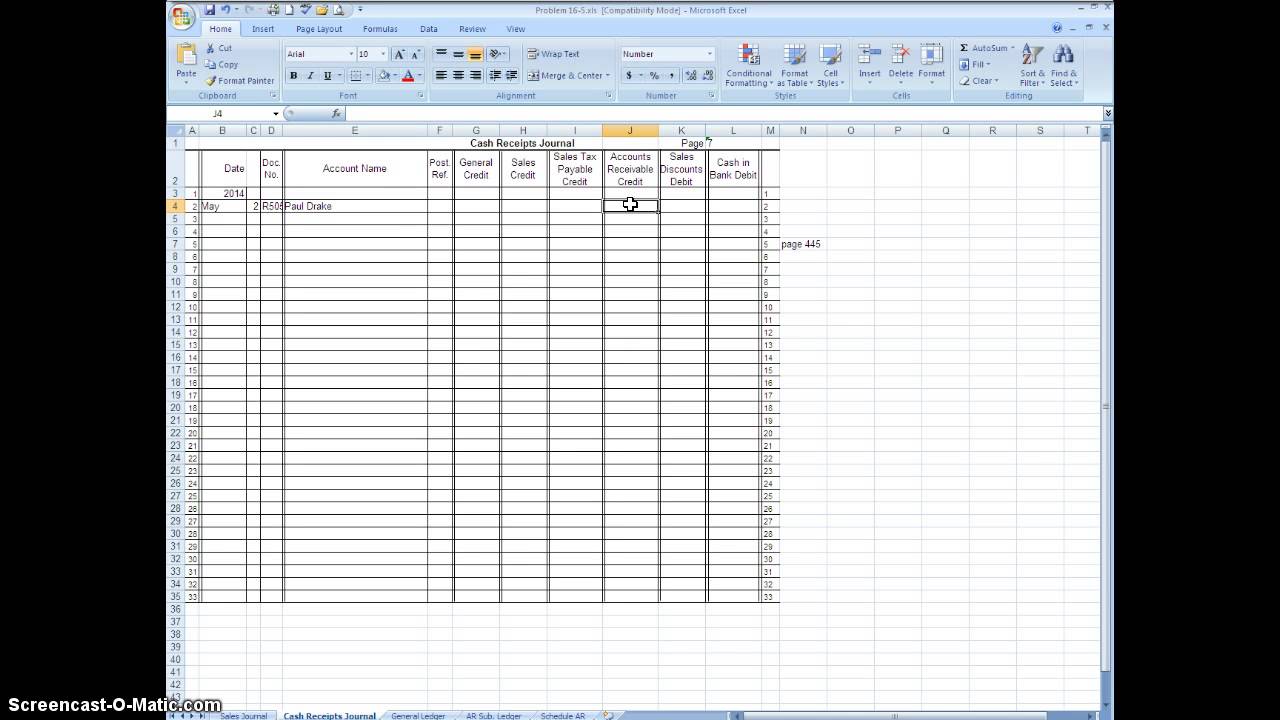

Tax may or may not be included in the sales receipt template, depending on whether VAT or other charges need to be included. If you look at any basic sales receipt template, you’ll usually see the following components included: This might be an email sent to the customer for online purchases, or a paper slip printed out from a cash register. How does a sales receipt work?Ī sales receipt is simply a record of a transaction issued at the point of sale. What is sales invoicing and how does it relate to receipts? We’ll cover the differences below. This is where a sales receipt enters the picture, a simple document covering the transaction details. The cardholder then goes to the merchant location and discovers that the merchant is bankrupt or out of business and the cardholder is unable to receive the merchandise.You need a record of sales for your business, and your clients need proof of payment. The sales receipt representing the balance must not be presented until the goods or services are delivered or performed.Ĭomplying with the above requirements will address situations where the cardholder has paid a “deposit” for merchandise that was agreed to be picked up at the merchant’s location by the cardholder. The merchant must note on the sales receipts the words “deposit” or “balance,” as appropriate. The second sales receipt is conditioned upon the delivery or performance of the products or services.Īn authorization must be obtained for the total amount of the transaction if it exceeds the merchant’s floor limit. When the products or services will be delivered or performed after the transaction date, one sales receipt represents a deposit, and the second sales receipt represents a payment of the balance.

0 kommentar(er)

0 kommentar(er)